Blogs

British Merchandising Consortium (BRC) told you eight hundred high-structure super markets and shopping malls might possibly be compromised when they provided inside a different income tax to your site having a great rateable well worth over £500,000. The cash team expected the fresh Treasury if the childcare entitlements and the limited tax program had been working as the government implied them. Edgeley brings in £160,000 however, incisions his modified net income in order to £95,000 as the, according to him, however just take household an extra £150 thirty day period if he gave up totally free child care and you will paid a 62% marginal taxation price. If authorities expanded the degree of free childcare on 1 Sep, advantages noticed a spike inside the attention from somebody such as Murton whom wished to avoid the £one hundred,100 trap.

Best Financial Incentives and Advertisements from September 2025 (around $step 3,: Bonus Bears Rtp $1 deposit

Lead put and prevents the chance that your own take a look at was lost, stolen, destroyed, otherwise returned undeliverable to your Irs. For those who don’t has a bank checking account, check out Internal revenue service.gov/DirectDeposit for more information on finding a financial or borrowing relationship that can open a merchant account online. Places – financing away from customers to help you financial institutions one function the primary financing of banking institutions – are “gooey,” especially in checking membership and you may reduced-produce offers membership you to definitely clients are also idle so you can empty out. Which stickiness from deposits implies that even when costs increase, a big percentage of deposits doesn’t obtain the highest cost however, stays during the those people financial institutions however, and you can people pay the “commitment income tax” on the lender. Specific dumps performed hop out whenever efficiency flower, and you can banking companies had to endure they by the precisely giving higher rates of interest.

Deposit money

For extra money, Bonus Bears Rtp $1 deposit users are able to use its See Cashback Debit notes to earn step one% cash return to the up to $step three,one hundred thousand inside debit card sales per month. At the same time, the college is not in charge if the college student brings wrong guidance or waits in the responding to a consult in the lender to help you look after any discrepancies. LendingClub bank, earlier Radius Bank, offers private examining accounts, a leading-give checking account and you may Cds. The fresh Rewards Bank account facilitate users maximize their offers by the generating one percent cash back to your certified sales, plus it provides very early use of direct placed paychecks. To start with a national student loan servicer until 2014, Sallie Mae has become an on-line bank and personal education loan merchant.

These issues, along with investment and you may margin pressures, would be issues out of intimate supervisory interest by the FDIC within the 2024. As with any receiverships, losses quotes was from time to time modified while the FDIC because the receiver away from hit a brick wall banking institutions carries property, matches debts, and incurs receivership costs. The new every quarter online costs-away from price of 0.65 % is flat from the fourth quarter but twenty-four base items more than first quarter 2023. So it price is now 17 base issues higher than the fresh pre-pandemic mediocre web costs-from rates. The credit credit net fees-from rates is 4.seventy percent in the first quarter, 122 basis things higher than the pre-pandemic average and the high rates because the 3rd quarter 2011. The’s annual speed of loan development went on to help you lowering of the newest first one-fourth.

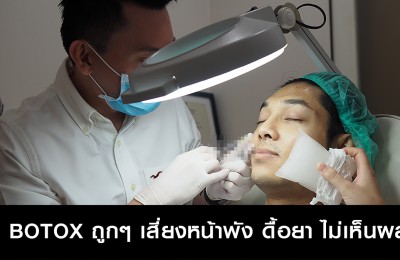

Tough for the medications strategies

A knowledgeable membership giving very early lead deposit have lowest otherwise zero charge, effortless account availability and you can highly-rated customer service. The fresh bargain have a tendency to mainly be paid for thanks to an excellent debit card revenue-discussing arrangement, just as the EDD’s previous deal with Financial from The usa. The newest company will spend $32 million more five years for money Network to offer an excellent long-talked about head deposit substitute for professionals’ bank account, that your EDD states often launch within the spring season 2024. A cards connection try a not any longer-for-profit banking establishment in which clients are theoretically region owners. Having section of a buddies form getting shares, which using the word “share” during the a cards relationship. Share permits, otherwise licenses, would be the borrowing from the bank connection same in principle as Dvds.

However,, as with most credit unions, membership can be limited to those who live in a certain region or features a romance that have a certain boss or team. Beginning several Cds immediately will likely be a method to grow your offers. Known as Video game laddering, this tactic comes to starting multiple Computer game accounts that have differing name lengths, to ensure that whenever for every Computer game grows up, you’ll gain access to an integral part of the deals. As the national mediocre savings rates remains lower, just 0.39%, according to the FDIC, of numerous Cds consistently shell out more than 4.00% annual fee yield (APY). The fresh account along with needs a minimum put away from $1,000, that’s higher than a number of other profile about this list.

You show them to be with every piece of information and you may invoices (where needed) to your expenses listed in the first column. Should your auto are subject to the brand new Depreciation Limitations, mentioned before, lose (however, wear’t improve) the new calculated depreciation to that particular amount. Come across Sales and other Feeling Through to the Healing Months Leads to chapter 4 of Bar. The brand new depreciation numbers computed with the decline tables inside Club. 946 for decades dos due to 5 which you own the car is actually to own a complete 12 months’s depreciation. Ages 1 and you may six pertain the fresh 1 / 2 of-season otherwise middle-quarter seminar to the formula for you.

Matthew Tevis, dealing with spouse and direct from Chatham Economic’s financial institutions party, says previous movements away from 20 foundation points or maybe more on the 10-seasons Treasury bond’s rate commonly strange. “Our very own balance-layer exposure government people, that is today providing banking institutions manage the asset-liability chance, is having accurate documentation seasons,” according to him. Part 1071 requirements have also been incorporated into the city Reinvestment Operate last signal, and that bodies up-to-date in the October inside a-1,500-webpage latest laws. Kelly claims the new CRA conditions is generally difficult for smaller banking companies doing work much more confined geographic segments, because the moving to arrive certain metrics can lead to better credit exposure. Along with, banking institutions are all the more competing facing nonbank borrowing business perhaps not subject to the brand new laws.